By Tim Leung, Ph.D.

In addition to the immediate price impact, earnings releases may also affect the drift of the stock price after the announcement over a longer horizon. This empirical observation is commonly referred to as the post-earnings-announcement drift.

Since many public companies also have options written on their stock prices, this motivates us to investigate the problem of pricing equity options prior to an earnings announcement (EA). As options are intrinsically forward-looking contracts, their prices should account for the uncertain stock price impact of an upcoming earnings release.

A natural question is how to extract information on such an impact from observed options prices, especially a few days before the announcement. Since traders often quote or study the implied volatility (IV) for each option, it is of practical importance to examine the behavior of the pre-earnings announcement implied volatility (PEAIV).

Pre-earnings announcement implied volatility tends to rise until the announcement date

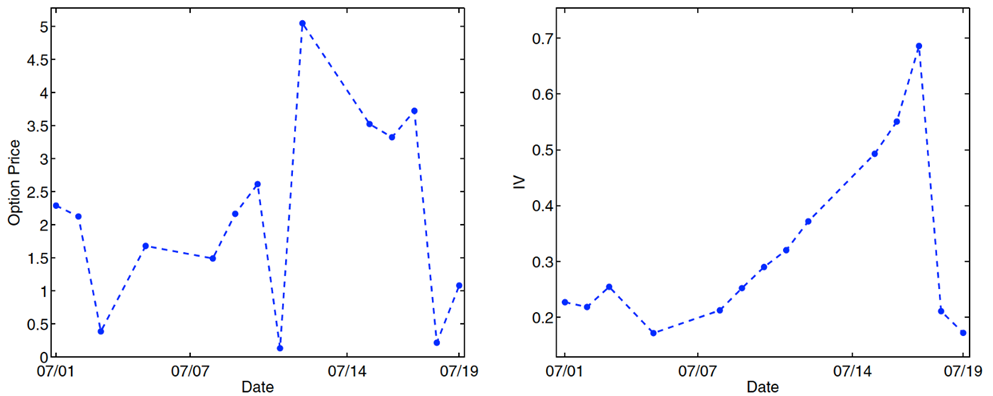

One main feature of the PEAIV is that it tends to rise, often rather drastically, up until the announcement date. In Figure 1, we show the price and IV of the front month (i.e. with the nearest maturity date) at-the-money (ATM) call option written on IBM. Following an earnings announcement, the option expires on the Friday in the same week. As we can see on the right panel, the IV increases rapidly from 30% to over 70% as time approaches the earnings announcement, and then drops significantly to close to 20% after the earnings report is released. At the same time, the ATM call price stays well above zero even though the time to maturity is very short (Figure 1 (left)). Moreover, we observe that the IV reaches a maximum just before an earnings event.

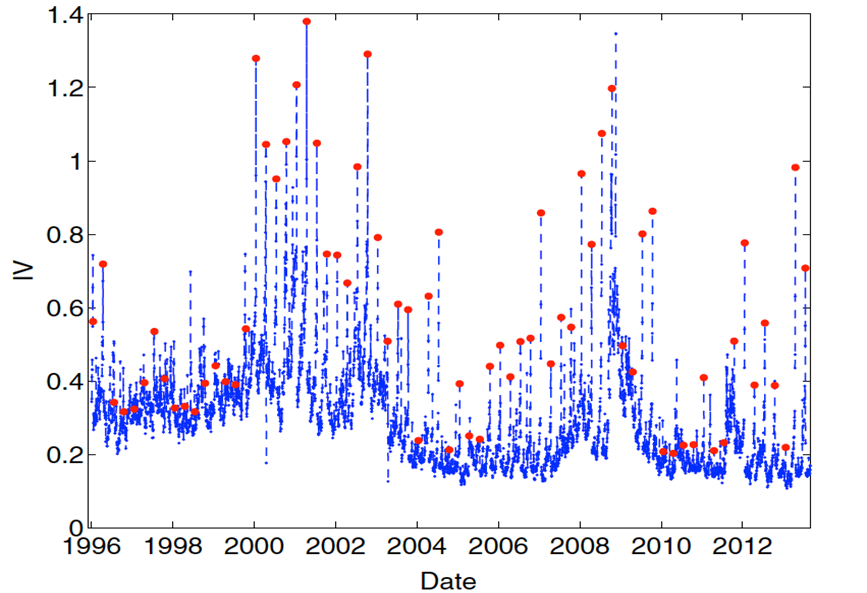

To illustrate that the increasing PEAIV is more than a coincidence, in Fig. 2 we plot the time series of the IV of the ATM call option for IBM from January1996 to August 2013. In the same figure, we mark in red the IV values on days during which EAs were made. As we can see, spikes in volatility most often coincide with the earnings release dates.

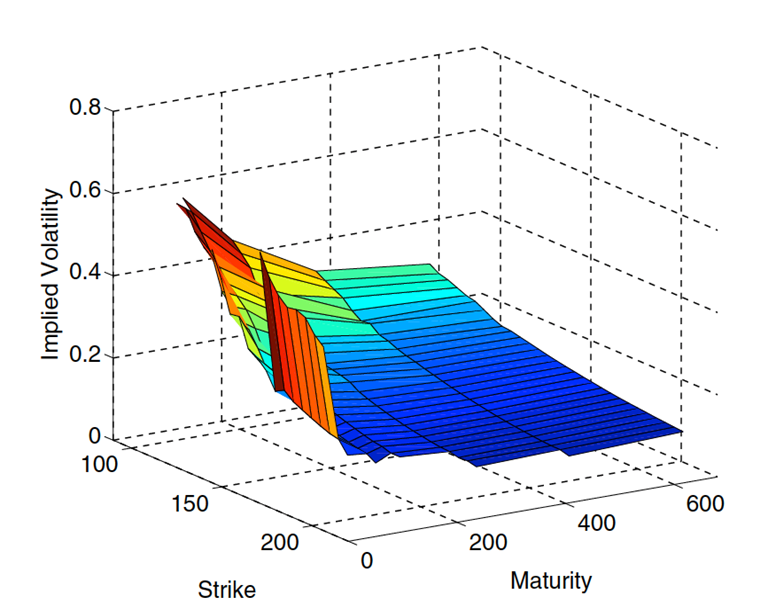

We can also gain some insight from the shape of the implied volatility surface. In Fig. 3, we show the IV surface of IBM on 15 July, two days before an earnings release. It is also clear that the front month options, which have 1 day to expiration, have very high volatility. The implied volatility is significantly lower for longer-term options, suggesting a less pronounced effect of the upcoming EA.

These market observations call for a pricing framework that explicitly incorporates the jump to be realized on the EA date. In this paper, a new option pricing framework is introduced to capture the price impact of an EA, with emphasis on the behavior of the implied volatility prior to the event. Specifically, a random-sized jump scheduled on the EA date is incorporated to represent the shock to the company stock price. Analytic bounds and asymptotics for extreme strikes are available for the IV under a general class of stock price models with an EA jump. In the bounds, we observe the explicit dependence on EA jump parameters and a common time-dependence of the PEAIV across these models.

References

T. Leung and M. Santoli, Accounting for Earnings Announcements in the Pricing of Equity Options [pdf;link],

Journal of Financial Engineering, vol. 1, issue 4, p.1450031, 2014

Disclaimer

This article represents the opinions and view of the author(s) and not, necessarily, of Rotella/Qdeck. The content of this article is provided solely for informational purposes and general education, and in no way should be considered investment advice.

This communication is provided for informational purposes and should not be construed as a recommendation or solicitation or offer to buy or sell futures contracts, securities or related financial instruments, nor as an official confirmation of performance. Past performance is not necessarily indicative of future results. Investment in any program is speculative and involves significant risks, including risks of loss. There can be no assurance that the programs will be able to realize their objectives.